By: Darrell M. West

Reported by: Aldwin Urbina (M1)

Chapter 5 / The Case of Online Tax Filing

Summary

As the previous chapter introduced online services, this chapter, on the other hand, presents one of the most popular government services provided online. Online tax filing is a system for submitting tax documents to an internal revenue agency electronically, often without the need for any paper documents. Generally, citizens who are comfortable using the Internet are likely to use online tax service because it is convenient, speedy and reliable.

Compared to the postal system, which occasionally loses parcels or has lengthy delivery delays, electronic transmission of tax documents is efficient and effective. There are several more incentives in using online tax service. On the demand side, such incentives include, among others, tax refunds due to overpayments are provided twice as fast those sent in paper copies, provides new tools for those who have physical disability, and reduction in errors from paper-based transactions. On the side of the government, advantages of online tax filing include, among others, reduced cost of storing and processing paper forms, reduced costs related to staffing and infrastructure in collecting taxes, and generates revenues for a wide range of services.

Non-paper tax filing emerged over the last two decades in the United States (US). Technologies that enabled such transaction scheme allowed taxpayers to file tax returns through telephones and then through other electronic means. The author identified three major types or modes of online tax filing. First, the TeleFile was introduced to enable citizens to utilize the telephone to transmit information where taxpayers made use of their telephone keypad to send income and tax information to the government. The TeleFile was less prevalent than other electronic mechanisms. Second is the most popular state-level tax option, E-File, whereby citizens submit their tax returns and payments through commercial firms. The firms collect citizen tax forms and electronically transmit them to federal and state governments. Third is the NetFile (or I-File) is the most recent and truly the most electronic option. Under this system, citizens file their tax returns online for free through the state’s Internet website. This option allows taxpayers to bypass commercial tax preparers and file returns directly with their state’s revenue department.

There have been issues on the implementation of the latter two modes. Commercial firms have opposed the expansion of Internet tax filing at the national level because they argue that private companies can do so more cheaply and efficiently than the national government. On the other hand, US President George Bush administration initially declared that the federal government should offer free online tax filing.

Despite efforts to promote online tax filing, most Americans still rely on the traditional mail delivery. From the national public opinion survey conducted by several organizations in 2002, two-thirds of American mail their tax returns rather than file electronically.

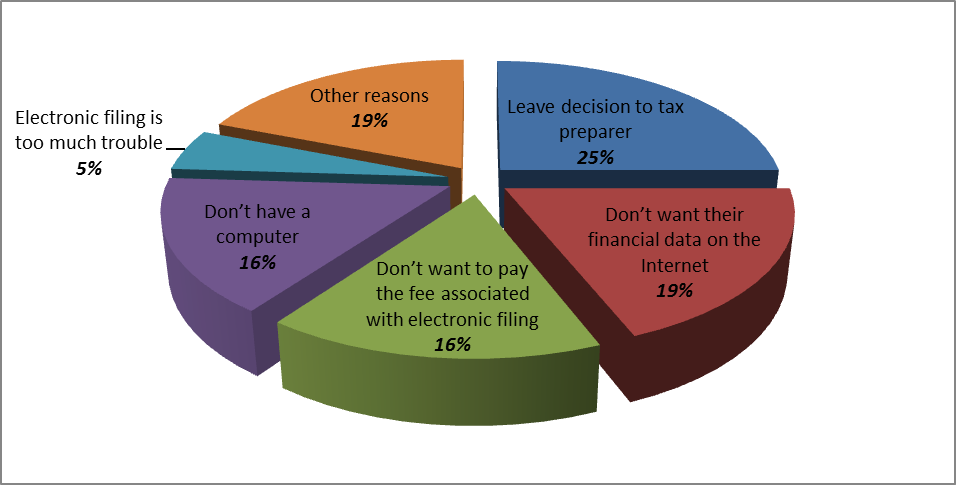

Figure 5-1. Results of the survey, conducted in 2002, on the reasons why US citizens still rely on mail delivery for filing tax rather than electronically.

For those who filed their tax returns online, satisfaction levels were quite high. Online tax filers enjoy the convenience and time savings associated with online services. However, expanding the number of online filers beyond those who already do so was challenging. This was mainly due to the lack of knowledge about how to file electronically. The absence of training programs made it difficult for the US Internal Revenue Service (IRS) to educate paper-filers on the advantages of online tax filing.

There is undeniable savings in electronic tax filing compared to paper tax filing. The cost differential is mainly due to the higher number of person-hours required to process paper tax returns. However, it is also important to look on the costs associated with putting up an online tax filing system. One factor that hampers the development of online tax filing is the investment needed for the implementation and maintenance of this service. States that are poor have been slow in developing online tax filing systems. Many agencies have been thwarted by lack of online mechanisms for credit card payments, debit card withdrawals, or electronic fund transfers.

Reporter’s Own Thoughts

The chapter clearly explained that governments are driven to provide services online because of the perceived advantages, among others, efficiency and time savings, in doing so. It also explained how electronic services, like online tax filing, are received by citizens in the US. It is drawn from the chapter that having created a system or technology that has great potential in providing operation and cost efficiencies in delivering government services does not ensure success if uptake or usage level of citizens is relatively low.