Evolution of renewable energy support schemes in France

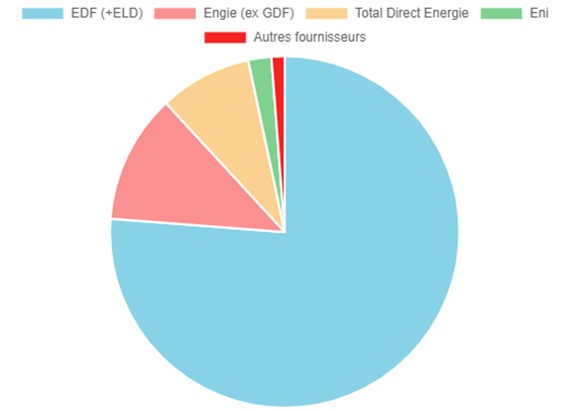

Until 1990, energy production and development in France was mainly controlled by the French government and only concerned a very limited number of public companies. The two main companies, EDF (Electricité de France) and GDF (Gaz de France) had the duopole of electricity and gas supply respectively. Concerning renewable energy, hydropower and a little bit of experimental tidal energy were used as side sources to produce electricity; biomass from wood and agricultural wastes was used for heating purposes. To enable more competition, especially in the electricity markets, the European Union required its member states to open their electricity markets to private companies in 1992 (1957 Treaty on the Functioning of the European Union article 106 – 1992 Treaty of the European Union article 4. This measure allowed for many changes in France as private companies like Total or the Italian energy company Eni started to gain more customers in the electricity market. GDF was renamed Engie and privatised, it also started to sell electricity in addition to gas. Today, Engie is the 2nd biggest electricity supplier in France after EDF. The electricity grid is operated by RTE for the transmission part (higher voltages) and Enedis for the distribution part (lower voltages). Both companies are owned by EDF. Most renewable energy facilities are connected to the Enedis network today.

Many of these new private companies played a role in the introduction of renewable energies from the end of the 90s. Because France has high onshore and offshore wind potential (2nd largest in Europe), as well as very good solar and geothermal potential, private companies were attracted and started to sell electricity from these renewable sources via the Feed-In-Tariff (FIT) scheme. To further spread the development of renewable energy, the EU pushed its member states to progress from FIT to auctions. The framework of renewable energy development and supply therefore changed in France to align with EU objectives. Under the Ministry of Ecological Transition (MTE), regional subsidies called DREAL were tasked to map the energy mix evolutions of regions until 2050 and to apply national directives via local actions. In 2015, MTE put into place the PPE system (Multiannual Energy Program) whose purpose is to set goals and at timetable for public authorities under a 4/5 years deadline (the next one is 2023 and the main objective is to increase the renewable energy generation to 73.5 GW). The Energy Regulation Commission (CRE) was put in charge of designing and organising tenders for solar, onshore and offshore wind, hydropower, biomass and geothermal energy under the PPE timetable. After examining and selecting potential winners of the auction, MTE reviews the CRE choice and has the final decision. Others public entities like the French Competition Authority (FCA) and the Environmental and Energy Management Agency (ADEME) were tasked to ensure the competitiveness of auctions and the positive impacts on the environment and the economy.

Auctions in France currently focus on one energy source only. Depending on the source and the size of the project, the process can be different:

- Solar energy: Facilities under 100 kW produce energy which has to be bought by EDF. Self-consumption is possible and encouraged financially, as well as community projects. For small-scale solar between 100 kW and 500 kW, the energy produced is also directly bought by EDF via pay-as-bid auctions. This category represents more than half of solar energy production in France and usually contributes to 40MW added every year. Because the threshold was close to the total capacity of projects, this category did not feature a lot of competition. Criteria have been revised to make the process more selective while remaining attractive for bidders. Large-scale projects (>500kW) tend to have lower bid prices than small scale. This category also uses auctions but the winners obtain a FIP (Feed In Premium) contract with the authorities: they sell themselves their electricity on the market and receive a bonus premium compared to FIT. Criteria for solar auction are the bidding price but also the environmental integrity (no deforestation, limited harm to biodiversity, limited CO2 emissions) of the project (up to 35%). In 2020, 88 solar projects were selected via auctions, representing 649 MW.

- Onshore wind: Projects who have less than 7 turbines and turbine capacities under 3 MW don’t need to go through auctions and obtain a FIP contract with the authorities to sell their electricity on the market with a bonus premium. Bigger projects have to go through auctions but the same principle applies for the winners. The only criterion is the bidding price. After the tender, the winners have 3 years to build the renewable energy facilities. From May 2017 to November 2020, 3.4 GW was awarded via onshore wind auctions.

- Offshore wind: For both floating and fixed offshore wind, projects are selected using auction and the winners obtain a FIP contract with the authorities. There were only 3 auctions yet but the PPE plans to have auctions each year starting from 2021. 7 fixed and 4 floating projects (3,520 and 24MW respectively) were awarded at precise locations chosen during auction design. None of them were implemented yet but the first project should be operational this year.

- Hydropower: Because almost all potential places for hydropower generation were already harvested before implementing auctions, EDF remains the only operator of hydropower plants. Nevertheless, the possibility of repowering auctions is considered to update the current power plants.

- Storage: Only hydroelectric storage is considered yet in the PPE, there will be auctions but details are not known yet.

The total process for auctions can take up to 4 years and 3 months. Additional to development, many administrative steps are required to obtain the construction permit from local authorities, the grid connection with Enedis/RTE and the operation permit with MTE for infrastructures bigger than 50 MW. Environmental authorisations have all been regrouped in one (regarding to the Environmental, Forestry and Energy Codes) but the total process still remains long. One reason is public approval, especially for wind projects as many of those face criticism from local inhabitants and need to go to court. The main reasons for disapproval of wind energy are the impacts due to the proximity to their houses (noise, visual aspect, shadow flicker…): some people fear it could have an effect on their health, on the price of their house, ruin the landscape, or endanger the local wildlife. Pro-nuclear activists also disapprove wind power because it replaces nuclear energy. The tender process could also be improved by making clearer and more straightforward: the possibility of a single permit regrouping all needed authorisations is currently considered. Bi-technological auctions (wind and solar in the same auction for example) are also a possibility but the process is still being reviewed today, according to the OFATE (Franco-German agency for energy transition) in the 2018 convention report

Sources:

- ADEME (2020, September 28). L’énergie en France. https://agirpourlatransition.ademe.fr/particuliers/lenergie-france (French)

- Carsten H., Benedikt R., Scott M., Nathalie B. & Simona B. (2020, June). Are voluntary markets effective in replacing state-led support for the expansion of renewables? – A comparative analysis of voluntary green electricity markets in the UK, Germany, France and Italy. Science Direct. https://www.sciencedirect.com/science/article/abs/pii/S0301421520302238

- ICLG (2020, September 21). France: Renewable energy Laws and Regulations 2021. https://iclg.com/practice-areas/renewable-energy-laws-and-regulations/france

- AURES (2016, March). Small-scale PV Auctions in France: Instruments and lessons learnt. https://www.auresproject.eu/files/media/countryreports/pdf2_france.pdf

- Centrales Next (2017). Que sont les appels d’offres pour les énergies renouvelables en France ? https://www.centrales-next.fr/glossaire-energies-renouvelables/appels-d-offres/ (French)