Reading report week 3-1 : Tomohiro Kazama (M1)

World Development Report 2016: Digital Dividends by The World Bank

Chapter 1 / Accelerating Growth

SECTOR FOCUS 1 : Agriculture

- This sector is focusing on how digital technologies are urging agriculture to change, and what changes are actually occurring. Agriculture, which is sometimes called the oldest industry, is also facing a rapid wave of digitalization.

- In this sector, agriculture is divided into the production part and the market part. And each of them are described from the perspective of “knowledge sharing”. While a variety of good influences have emerged, it has been noted that some lessons have also been learned.

Enhancing on-farm productivity (production)– Agricultural productivity is highly variable, not only by the topography and climate, but also by technical factors such as management methods. The level of technology varies greatly from region to region, and there are disparities. A variety of assistance has already been provided to correct this disparity, but not been able to get the support to go to the details.

The spread of digital technology has made it possible for support agencies to provide actionable information and advice to farmers at a lower price and faster than ever before. Moreover, digital technology is creating a succession of services to help farmers, such as support using electronic payments and real-time weather forecasting. It is becoming possible to increase productivity through the use of various supports and services through smart phones.

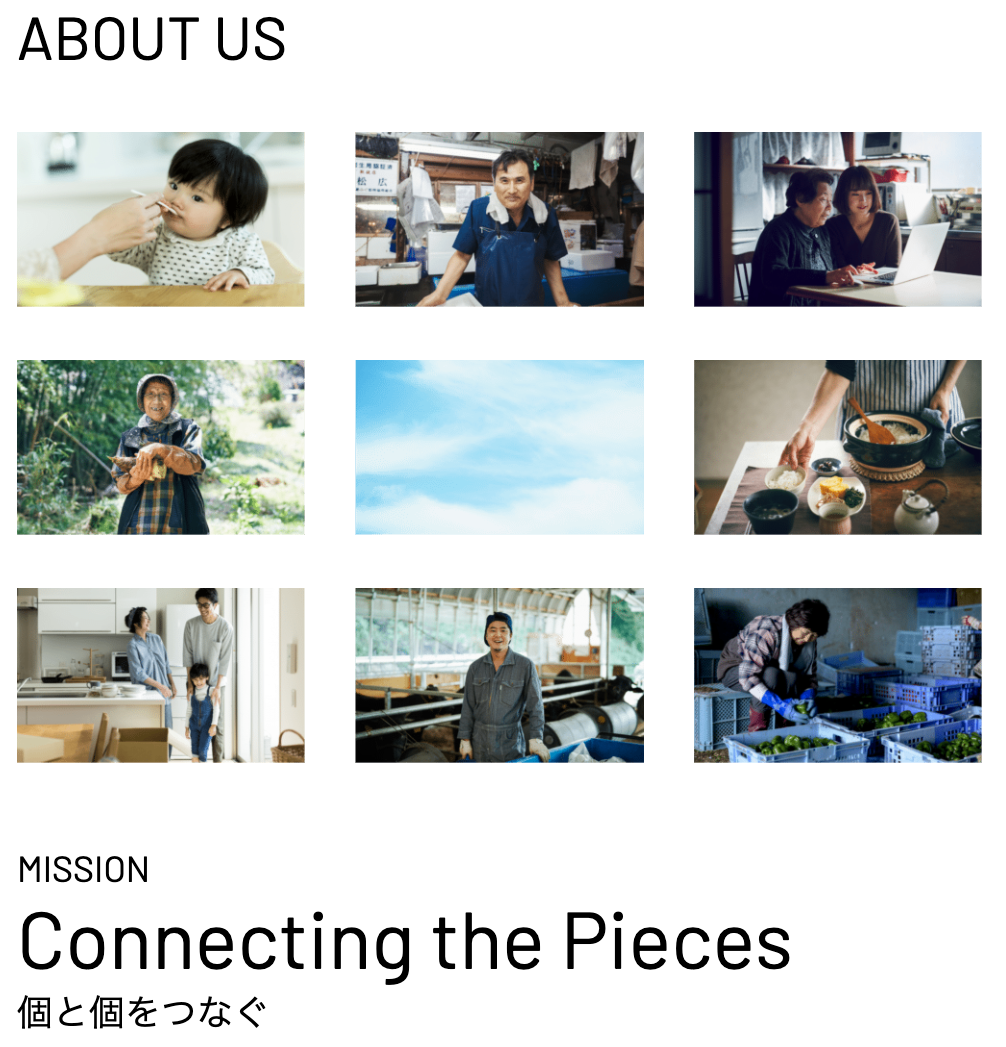

Users can search for products and producers, and also check posts from producers and other users. Source: Pocket Marche <https://www.pocket-marche.com/>, Inc., <https://www.pocket-marche.com/service/>, permission obtained from the company.

Facilitating market transparency (market)– Digital technologies have increased the transparency of agricultural markets in developing countries, which were previously unclear. Agricultural markets in developing countries were scattered across regions, and information, such as prices, was not exchanged between them. However, with the spread of smartphones, such information has come to be exchanged. Producers can buy in more expensive areas and consumers can buy in cheaper areas. This has reduced the regional and diurnal price change.

Enabling efficient logistics and improving quality control (market) – Digital technology has the power to change the supply chain. The digitalization of market management has made it easier than ever to track complex supply chains across the globe. This will not only improve the efficiency of the supply chain, but also ensure safety.

In addition, being able to easily find out where and what is being traded at what price has made it easier for producers to provide their crops to a larger number of consumers. This has created new markets and new supply chains that do not involve existing markets. This will not only make the market more efficient, but will also bring producers and consumers closer together than ever before, making them more secure.

Lessons for adopting digital technologies for agriculture – There are three things to be aware of when it comes to the diffusion of these digital technologies in agriculture.

- These digital technologies have become so sophisticated that the amount of investment required has become so expensive. Therefore, the widespread use of digital technology could encourage economies of scale and makes it difficult for smallholder farmers to enter the market.

- Second, simply expanding the market and making it more efficient is not a win-win for farmers. Other factors such as the local culture and logistical environment must also be considered.

- Third, the use of digital technology requires an underpinning. Without the infrastructure in place, such as electricity and literacy, they cannot fully benefit from digitalization.

Specific cases in Japan

Picture 1: An example of the interface of the Pocket Marche smartphone app. Users can search for products and producers, and also check posts from producers and other users.

This digitalization of agriculture has become a new service here in Japan. An example of the interface of the Pocket Marche smartphone app.

In addition to being able to search for products and producers, you can check user posts and kings

A example that is creating a new supply chain in Japan, is a service called “Pocket Marche”1). It is like online marché service, connects consumers and producers and allows individuals to buy and sell among themselves. Their mission is “Connecting the Dots” and their goal is to realize the “Society of Mutual Assistance“.Consumers search on the platform by ingredient name, etc., and purchase the product they want. Each product has information about where and by whom it is produced and with what thought, and payment can be made by credit card.

The characteristic of this service is that it is not just a platform for buying and selling foodstuffs, but also allows direct communication between producers and individuals just like a social networking service, and allows them to post about their products.

The main reason why I introduce this service here is that the phenomenon that occurred during the expansion of COVID-19 caught my attention. Due to the spread of COVID-19 infection, many restaurants and school cafeterias in Japan have suspended operations. As a result, farmers and fishermen who were providing them with food temporarily lost their sources of sales. Under these circumstances, Pocket Marche is playing a role in connecting farmers and consumers who want to support them, by spreading the hashtag #新型コロナで困っています (#I’m in trouble with COVID19) through confidence and other SNS.

Isn’t this a good example of the new supply chain and market imaginings we’ve been discussing? Although this service did not start with COVID19, it has shown great expansion with COVID19. This was undoubtedly because farmers were looking for new sales channels for digital agriculture, consumers were looking for it, and Pocket Marche was able to respond to those requests.

Source: : ポケットマルシェ <https://www.pocket-marche.com/>, Pocket Marche, Inc., permission obtained from the company.)

Reference

- 株式会社ポケットマルシェ _ Pocket Marche, Inc.( https://www.pocket-marche.com/)

SECTOR FOCUS 2 : Enable Digital Development; Digital finance

- Digital finance can provide financial services to more people, faster, more accurately and without waste.

- Digital finance can help bring financial assistance to people who have been left out of financial services. In addition, because digitalization is easier to manage, we can take effective measures more cheaply and quickly, and use the data to promote the development of other services and innovation.

Benefits of digital finance

Digital finance can promotes financial inclusion – The spread of digital finance make it possible for more people to access financial services. As of 2015, more than 2 billion people were unable to access any financial services. Furthermore, only about half of the people in developing countries have an account with a registered financial institution, and these people are not able to receive support from the government quickly and smoothly. Digital payments can give these people access to financial services with lower costs.

The reason why digital finance is effective is not only to make people accessible. In the case of digital finance, financial support can reach faster than in other methods. This can be very useful in emergency situations such as disasters. Other than that, it is easier for donors to control the use of their money, which leads to more appropriate and effective support. It also makes it easier for vulnerable people, such as women, to receive support and make use of it, and encouraging them to be active.

Digital finance can increase efficiency – What’s more, digital finance makes it easy and inexpensive to provide loans and financial support. For example, digitalization will lead to automation and specialization of various processes. By doing so,

- Reduction of procedural costs and losses previously incurred due to procedural errors and fraud

- It is easier to reduce costs by taking advantage of economies of scale by dividing the work into steps and having a professional provider take charge of the work

Digital finance sours financial innovation – Digital finance has allowed suppliers to boil down large amounts of customer data. These data have been the source of a variety of new financial services. These are called fin-tech firms, and they provide short-term loans and money transfer services at low prices by automating screening and other processes.

Managing risks

The expansion of digital finance services raises a number of issues. They can be summarized as follows.

- Laws and regulations have not kept pace with the evolution of financial services.

- Protecting the Financial Novice

- Negative impact on the existing financial system

- The occurrence of new fraudulent activities such as cyber attacks and money laundering

- Lack of frameworks for addressing the rise in cross-border financial crime

The monopoly of data and services by so-called digital platformers, not only in finance, has become a big problem. In addition, financial services that were previously available only to people with a relatively good knowledge of finance have become more accessible and accessible to everyone. With that, financial novices are also taking advantage, increasing the potential risks. While it is easy to apply various regulations to fintech companies to solve these problems, it is not easy because of the risk of stifling free competition and innovations. However, some services, such as digital currencies, have emerged that could upend the roots of the existing financial system. The freedom of competition and the risks are constantly being compared and countered.